Exactly one year ago, I bared my finances to the world and explained how I needed Rs. 3.11 Cr by the time I reach 55. This would give me a monthly income of Rs. 3 Lakhs which I determined would be enough in 2037. A year ago, my net worth was just 8 Lakhs, but even with that limited amount, I just needed to save only Rs. 5,000 per month to achieve my goals.

The last one year has been good to me. But I’ve also begun to think that I’ll need more than 3 Lakhs a month in 2037. That’s the equivalent of just Rs. 30,000 now and just to be safe, I’ve increased my retirement goals to Rs. 4 Lakhs a month, or Rs. 40,000 in today’s value. That should cover expenses like Insurance premiums too. I think a middle aged couple can get by these days on 40 grand a month no?

It’s time for the yearly review of my retirement goals to see how much more (or less) I need to save. Keep in mind that I’m a paranoid bugger – I like to assume the worst!

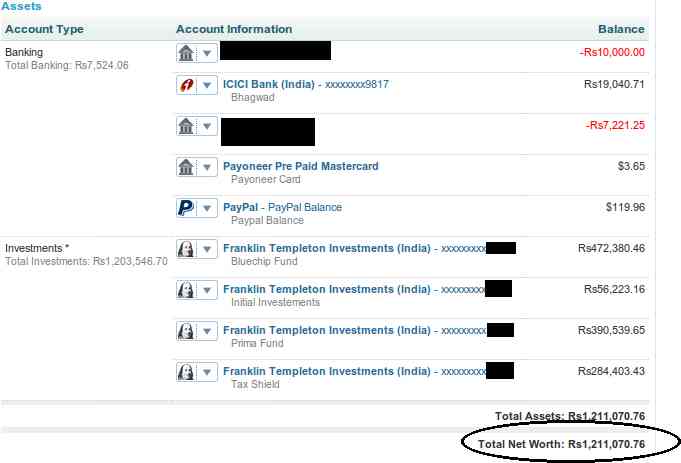

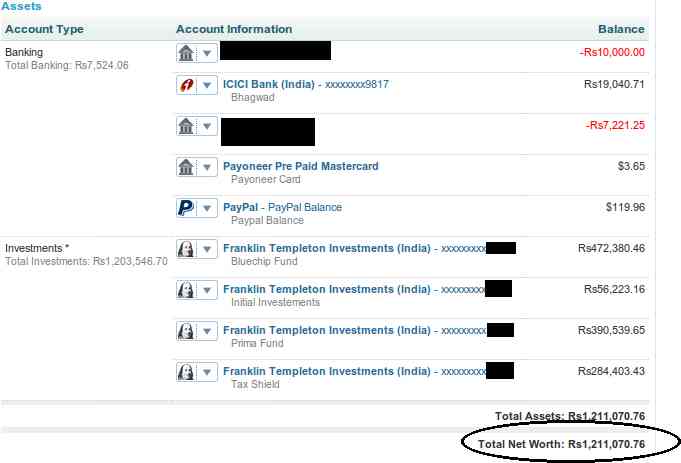

Here’s my net worth as of today (Click to Enlarge):

I’ve increased my assets by 4 Lakhs compared to last year to bring my total to 12 Lakhs. A goodish amount and as I said, the stock market has been good to me. I’ve invested mainly in mid cap companies because my long term risk appetite can stomach it. And of course, ELSS tax saving mutual funds. But with the DTC on the anvil, those are set to be abolished. I’m not about to start investing in the NPS though. 100% equities are still a much better investment for a long term retirement guy like me.

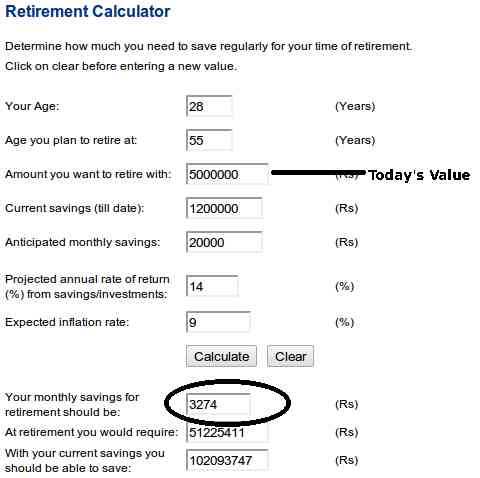

So given my current situation, how do I go about netting myself 5 Crores? As before, the awesome retirement calculator from RBS comes to the rescue:

To get Rs. 40,000 a month today, I’ll need around 50 Lakhs capital – and that’s what I’ve put into the calculator.

Just Rs. 3300 per month and I’m through! It makes me happy to see that even after the increase in my retirement goals I still have to invest a little less that before. I’ve just made two changes. First, I’ve increased the inflation rate to 9% just to be on the safe side. Of course, over 27 years the inflation rate is bound to come down dramatically, but that’s just icing on the cake. Also, I’ve increased the projected rate of return to 14% from 12%. This is more realistic and in fact I expect it to get much closer to 20%! But as before, I like to prepare for the worst.

The great variable in all this is medical expenses which I will expect to see shoot up as my wife and I get old. Incidentally, these figures don’t take into consideration my wife’s own retirement savings – so that should be another bonus as well.

It’s good to have your bases covered isn’t it?

You are really focussed – cool…I wish my husband and I were…All our money is in savings accounts…

In reply to sraboneyghose

At this time I'm terrified of savings accounts…with inflation being what it is, bank accounts will actually lose you cash year on year. Of course, if you need the liquidity then nothing like it…

Its good for you and others. In our times there was no terminology of Financial planning except for marriage expenses!

In reply to S.R.Ayyangar

You're right Ayyangar – we're quite lucky we have these tools to help us grow our money these days.

You got a focused and disciplined lifestyle. Will try to learn a bit of lesson from you atleast take it as an inspiration :) Am bad at financial planning, now I have left it to my better half who armed with a CA is better equipped than me who plans through heart not through greycells. :P only thing that greys in me is my beard ;)

In reply to Lakshmi Rajan

Our situations are different then. My wife enjoys spending all her cash while I jealously guard my own!

Could you tell me which tool you use to manage your assets?

In reply to Navi Arora

I use Yodlee. Their systems are the backend for a lot of banks worldwide including the Bank of America. Have been using them for years now.

The 5 of the greatest words ever spoken in this materialistic world –

“To be rich is glorious”

Not to rock your boat or anything but 40k in today’s world (even if you already have a house and don’t have to pay rent – assumption) is a tough one. Inflation has meant that every vendor has increased prices but not decreased them when rates come down. So all luxuries will be cut out. Do overestimate a bit more on expenses.

What about a fund for medical expenses?

In reply to Sangitha

Good points! Actually I’m massively underestimating how much cash I’m going to have at the end. I need to save just around 3,000 a month but I’m actually saving something like 20k – the reason is that I really have nothing much to spend my money on…

40,000 a month for me right now means I get to save at least 25 thousand per month. I guess I just don’t need that much to live on :)

Health fund is definitely a problem. I’ve looked around but as of now there don’t seem to be any good old age health insurance schemes. I think I’m going to roll with this one and see how things turn out. Don’t have a figure regarding how much I need to save for health.

ICICI Pru Health Saver is a good plan where you use MFs to build up a fund, we have a once a year premium. Tough to figure out how much one will need for health, only that we will need something and the pain is that costs are increasing like crazy.

In reply to Sangitha

Just checked out ICICI Pru Health Saver. It seems the maximum age for this policy is 55 years – Just the age at which I’m set to retire! I need something for older people…

In reply to bhagwad

That’s maximum age to enter the plan.

In reply to Sangitha

Oh really? Then that’s good. I’ll check it out. Thanks!