In this post, I’m going to lay bare my finances to the wide world. Most Indians I know are hesitant to discuss this aspect of their affairs (perhaps even more than their sexual ones!), and here I disclose full details with screenshots of my finances with nothing hidden. Call me an exhibitionist, but it’s fun to do what I haven’t seen anyone do before!

Retirement Goals

But to start off, this is my retirement goal: I need to have a monthly income of Rs. 3L (3,00,000) when I retire. I figure I’ll need this much when I retire since inflation will be 7.8% and Rs. 3L will be equal to around Rs. 30,000 in today’s value after 28 years (time till I retire). My wife and I feel that if we were old right now, we can easily get by on Rs. 30,000 a month.

So to get a monthly income of Rs. 30,000, I need to accumulate Rs 3.11Cr (3,00,00,000) by 2037. I want to retire when I’m 55.

So final goal = Rs. 3 Cr by 2037.

Current Status

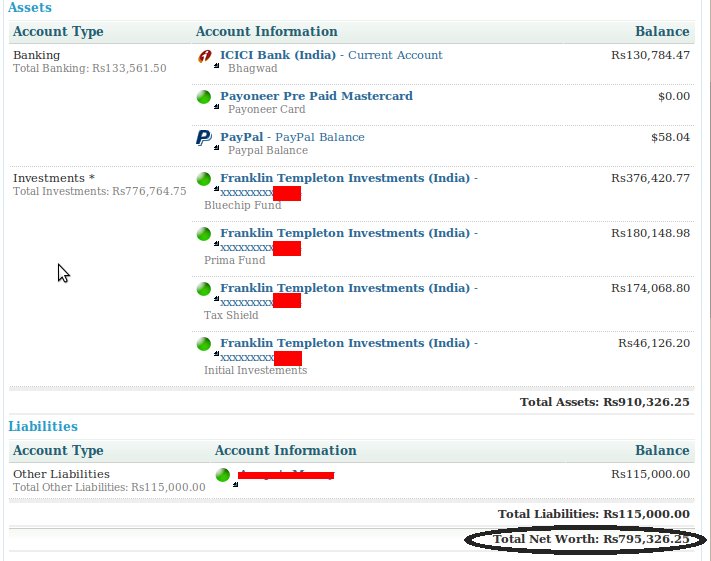

I’ve been investing since I started earning (haven’t missed a month in 6 years) and over that period, have managed to accumulate 8L till date. The recent crash and subsequent rise of the Indian Stock Markets has more than tripled my assets. So here are my assets as of the 27th of September 2009 (Click to Enlarge):

(The red smudged “Other Liabilities” is a person for whom I’m temporarily holding some cash – so it counts as a liability). And to ease the fears of “other” security conscious people in my life, I have graciously consented to blur some account numbers….Ok ok, I guess it makes sense :) – As the Chief Whip said in Yes Minister – “Open, but not gaping!” In case you’re wondering what cool tool I use to generate my financial reports, it’s called Yodlee – a free online financial aggregator whose clients include Bank of America and other large corporations, so I trust them.

What I need to do to reach 3.11 Cr by 2037

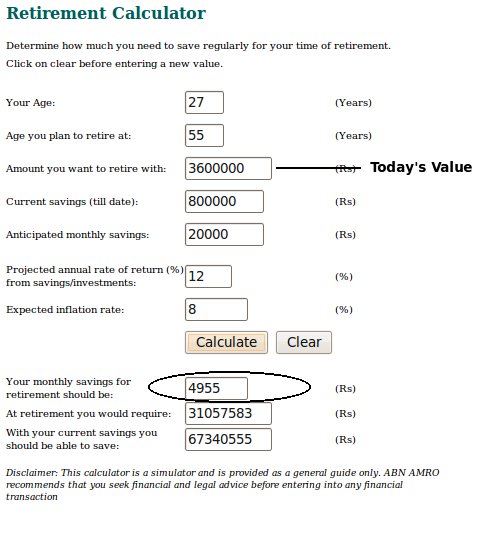

I invest only in the Stock Market and as such, I expect excellent returns over the next 28 years. I never take cash out and keep investing per week. Based on historical records, I should get well over 15% per annum, but to be on the safe side, I’ll forecast for only 12%. Plugging the figures into a simple retirement calculator, this is what I get:

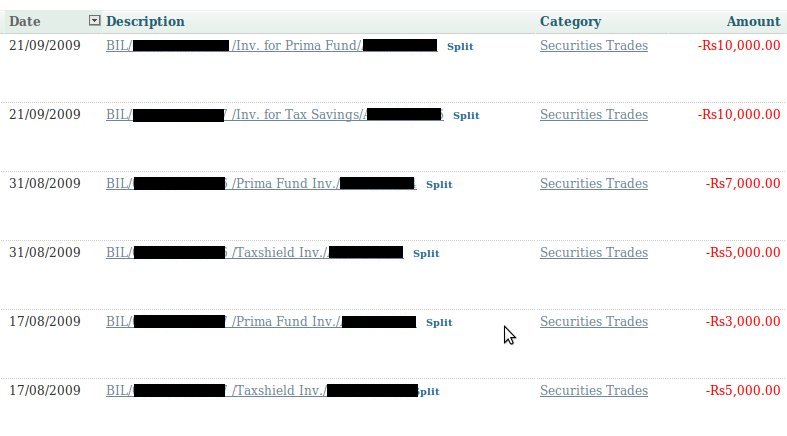

So the good news is that I now only need to invest a minimum of Rs. 5000 a month to reach my targets by 2037! I currently invest a minimum of Rs. 7,000 per week – half in a Tax saving ELSS scheme and the other half in Mid Cap companies (I can afford to take on risk since I have a large time span). Here are my investments for the past one month (Click to Enlarge).

So I find that I’m currently investing around five times more than what I need to invest. Ooh la la! It makes me imagine how much bare minimum I need to earn to live comfortably and keep investing at the same time. When I calculate it, I need to earn just Rs. 15,000 a month (instead of the 35 – 40 thousand I earn right now). Given that I charge $20 an hour, I need to work less than an hour a day – on weekdays only of course ![]() – for the next 28 years to achieve my retirement goals!

– for the next 28 years to achieve my retirement goals!

Makes me think I have quite a good life. No babies, no house rent etc. The only thing maybe I’ll need to worry about is medical expenses. Thinking of taking out some insurance when I get back to India – I’m still not convinced either way. Ideas anyone?

Dude.this has to be one of the most honest and cool posts i have read till date..whew..i am amazed…i havent and wont read the details of this post,but the whole idea seems awesome..now let me fwd those links to my partner,who ideally shud be minting money while i sleep.

Hi

Your process of thinking is exactly the way it should be :) . You have done a great job and your analysis looks great .. There are some thing I would like to add which may improve things here , i hope :)

– Inflation of 7.8% . Inflation for last 30 yrs gives an average of 6.5% . So May be you can consider that , however taking it as 7.8% is great , just that you will have extra money at the end .

– Also Plan how many years after retirement you want to get monthy income , even if you cap your age at 100 , You will have to make little less than your target amount, may be 5% less . This is not very important btw .

– Now comes the Fun part

* Given that you already have 7+ lacs of savings , If you just keep it as it is and dont invest anything further , you will still make 1.65 Crores in 2037 (@12%)

* So to reach the target of total 3 crores , you need to make 1.35 crore more for which you have two choices

1. Either invest 5000 per month till 3037 OR

2. Invest 12,000 per month for next 5 yrs (till 2014) and then dont do anything .

Given you currently invest 5,000 per week , You should be able to make 3 crores by just investing for next 3 yrs and then stop it :)

Get more details on http://www.jagoinvestor.com/2009/09/key-to-excell…

Manish Chauhan http://www.jagoinvestor.com

You are way ahead of most of us. But don't forget, things can change quickly. Just stay flexible; you never know what the future holds.

@Manish Chauhan

Thanks for the analysis! Amazing that I just have to work for three years more at the rate I'm going now.

Of course after that I'll still need to earn money for my regular expenses – so can't slack off yet :D

@bhagwad

Test comment. I think it is a nested reply and sits below comment #5! Is it not?

Yes, but if you reply to an earlier comment, the reply sits at the end of the thread instead of just below the "replied to" comment.

Try replying to comment #3 for example…

@Vikas Gupta

Right – see the comment is attached to the end of the threat…must be something with your blog with hosted with wordpress.

Do you use any plugins relating to comments?

@Vikas Gupta

You are right. I guess it is an Inove issue; check out the forums/support. Must be some bug etc. See this one for example http://wordpress.org/support/topic/259644

There are so many great themes freely available for self-hosted blogs; why are sticking with this one I wonder! I guess it looks clean and simple.

@Vikas Gupta

I saw that support forum too – and like them, I couldn't find a solution either.

I tried shifting away, but my wife raised an outcry and another friend of mine said that the new one looked liked like an RSS feed! So I switched back :D – the readers are what makes this blog more valuable after all!

@bhagwad

Mine is hosted on WordPress only; it's a free blog. We cannot use any plugin. Nested comments is an option there just like the self hosted WordPress dashboard. Sometimes some theme features also clash with your installed plugins.

There are so many rocking themes man [esp. the magazine themes]; you'll love them! Try them sometime.

There are themes that will make your blog look awesome that your wife or friend or visitor: just anybody will love! You must have installed some dull theme!