As a freelance writer, I was hit hard by the recent Paypal outage which prevented me from withdrawing funds from Paypal into my Bank account. Out of desperation, I decided to try Moneybookers [That’s an affiliate link btw :) ] as an alternative to using Paypal for withdrawing money to my Indian bank account. And while I still get payments into my Paypal account, oDesk has an option to withdraw my funds into a Moneybookers account.

I was a bit hesitant going into Moneybookers because I had heard a lot about how they supposedly freeze accounts and charge high fees. But as I said, I was desperate and I’m glad I decided to open a Moneybookers account – it’s cheaper than Paypal with better currency conversion fees and it delivers cash into my account just as fast. The only hurdle to using Moneybookers fully is their highly strict verification process. I had to verify my Email ID, my card, my Bank account, my address (twice) and finally my ID. After all the verifications however, my account is fully operational with very high limits.

Moneybookers is based in Europe, and their strict verification rules stem from implementing the UK’s anti money laundering procedures. People who have their accounts frozen have likely not completed all the procedures required by Moneybookers.

For those in India thinking of using Moneybookers as an option for withdrawal of funds into Indian bank accounts, here is a detailed account of how I set up my account and got verified step by step.

Opening an Account

Opening a Moneybookers account is simple. Head over to the Moneybookers home page and click the “Register” button. Be very careful while filling out the registration form, cause I gotta warn you – they’re going to check everything! Also, ensure that you choose your account’s currency carefully. You can never change it after this. And finally, be warned that you can have only one Moneybookers account. If you try and create two (they’ll likely find out if you do), your accounts will be frozen and there’s no use crying afterwards. They take their security procedures very seriously.

I receive all my payments in USD and I chose to have my Moneybookers currency set as USD, since this allows me to escape two currency conversion fees. If you instead choose a currency such as Euros and you receive a payment in USD, you’ll be hit with currency conversion fees twice – first from USD into EUR and then EUR into INR when you withdraw to an Indian bank account. So choose carefully!

Email ID and Physical Address Verification

Once you’ve opened your account, you’d better start the verification procedures ASAP. Your account is never fully functional until you do and even if you don’t hit your withdrawal limits, Moneybooker’s security team is likely to force you to verify your account if you don’t do it soon. The Email ID verification is simplicity itself. They send an email to the address you provide and you click the included link to verify it.

There are two physical address verifications. The first verification is designed to check whether the person who has opened the Moneybookers account really lives at the address provided. Mind, this isn’t a name verification yet. Just a check to see if you’ve given a valid address. When you try and verify your Indian address, Moneybookers will send you a physical letter containing a 6 digit number which you have to key into the Moneybookers verification page. If you enter it correctly, your address is verified and your money sending and withdrawal limits are increased.

I live in Chennai and I got the letter from Moneybookers in 5 days or so. Pretty neat!

Credit/Debit Card Verification

The second step is to verify your card. It’s important to note that you can verify your card only if the name on the card is the same as the one you signed up with on Moneybookers. For verification, they charge your card a small amount and you have to then enter the exact value taken from your card. This proved to be a bit difficult for me for two reasons. First, I don’t have a credit card and when I tried using my ICICI debit card, the verification failed. Apparently Moneybookers didn’t like it.

I bank with ICICI and some time ago, I signed up for a b2 branch banking account – a completely online bank facility which has an “eWallet”. I tried using these details for card verification and it worked! But then a problem occurred. Moneybookers wanted me to enter the amount debited in USD and since my ICICI account was in INR, I only saw the INR value! I tried guessing the value based on the conversion rate and was confronted with a stern message in red saying “Please DO NOT TRY and guess the amount” after which they disabled the verification for 24 hrs – Ouch.

So I contacted the b2 bank using their online chat facility (damn neat that is) and asked them to give me the exact USD value debited. After a bit of checking, they confirmed that it was exactly $1.51 . I waited for 24 hrs, input the amount into the Moneybookers verification screen and voila! It was correct, I was verified and my account limits were increased further.

Adding and verifying a Bank account

This was the most difficult part of the verification procedure for me. There are two ways to verify your Indian bank account with Monebookers. First, you can upload some funds to the Moneybookers account via a wire transfer. The other is by withdrawing some funds to your bank account from Moneybookers first and then entering the verification code that they send along with your first withdrawal. Neither of them worked for me though…

The first step is adding your bank. You need to know the SWIFT code of your bank for Moneybookers to wire the funds to you. On the receiving end, my ICICI bank charges me Rs. 25 for each incoming wire transfer – quite reasonable. Sadly, though all banks have a SWIFT code, not all branches do. After trying in vain to find out the SWIFT code of my ICICI bank branch, I decided to call ICICI and find out what it is. The customer rep asked me if the sender was sending funds in USD or INR. I naturally assumed that the funds were being sent in USD (since my funds are stored in USD) and I obtained the USD specific SWIFT code for ICICI.

However, when I put in the SWIFT code, Moneybookers didn’t recognize it as an Indian bank. So after a lot of searching around, I finally got the correct SWIFT code for ICICI which is ICICINBBNRI . What seems to be happening is that Moneybookers is first converting my USD to INR and then sending it to the bank I specify. So naturally it counts as an INR transfer and not a USD. At least, that is what I think is happening. At any rate, my funds sailed through to my bank account in just two days. To be on the safe side, I had withdrawn only the small amount of $14 the first time. I was pleasantly surprised to find a conversion rate much better than Paypal’s.

Moneybookers Bank Verification

Eagerly I searched for the verification code that was promised along with the wire transfer details, but didn’t find any such code. I was informed by Moneybookers that it would be a 6 digit alphanumeric code preceded by “VRF CODE”. But after many calls to the ICICI NRI department, no such code was found.

Disappointed, I decided to opt for the other method of verification namely uploading funds from my bank account to Moneybookers. Armed with all the details I walked over to ICICI to make the transfer, when I was informed that each transfer would cost me more than $30! I couldn’t afford that, and so I came home disappointed.

I contacted Moneybookers customer support over the phone (using Skype) and told them that it was too expensive for me to upload funds to Moneybookers and that I hadn’t received any VRF CODE in my first withdrawal either. They kindly offered to verify my bank account manually and asked me to send over either a screenshot of my online bank account or a scanned copy of my bank statement. The details they wanted shown on the document were:

- Bank account number

- Name of the person (my name)

- Transaction details showing the withdrawal into ICICI from Moneybookers

- Date of the Transaction

- Moneybookers as the sender of the funds

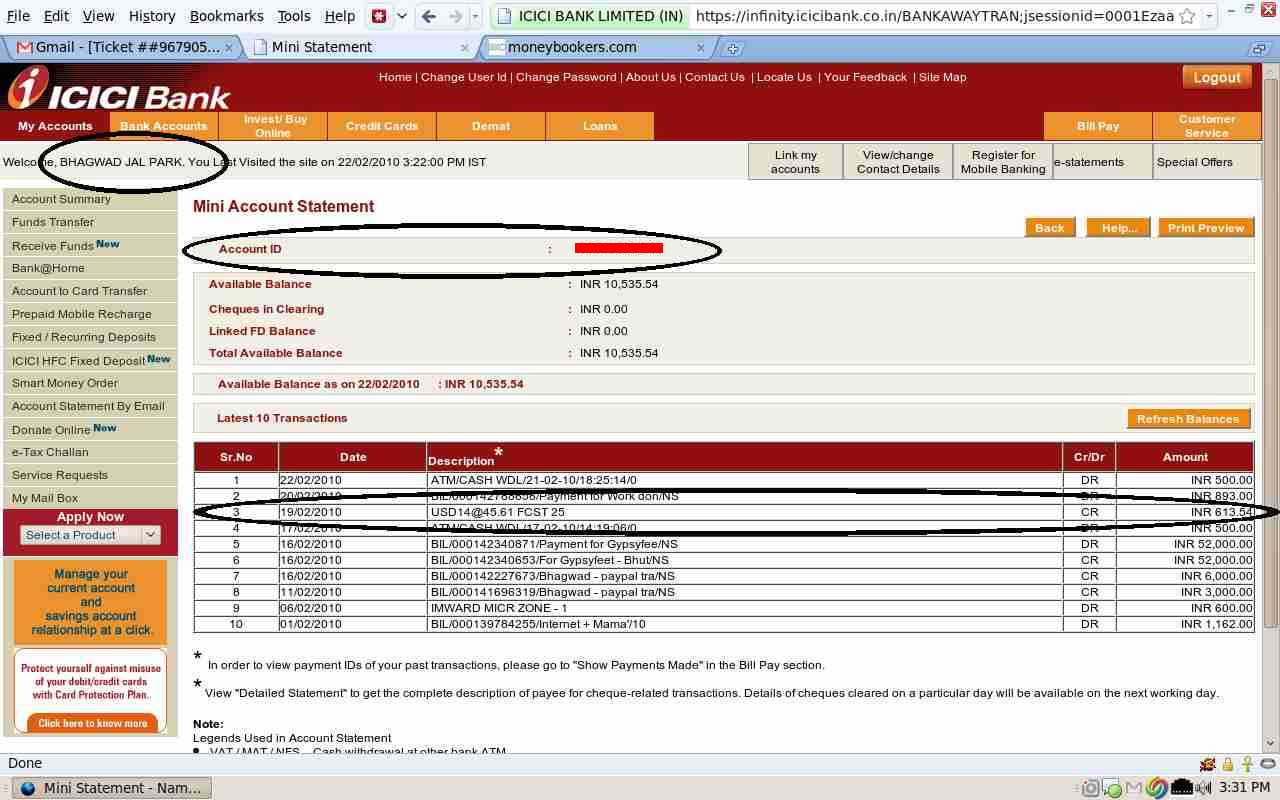

I took a screenshot of my online statement and circled the relevant details in black. Here is what I sent over:

Unfortunately for me, all the needed details are visible except No. 5 – the name of the sender (Moneybookers). Their security team rejected the screenshot saying so, and asked me to send them the physical statement of the bank. I called ICICI and asked them if the physical bank statement would show Moneybookers as the sender, and they told me that they couldn’t see the details of the sender themselves!

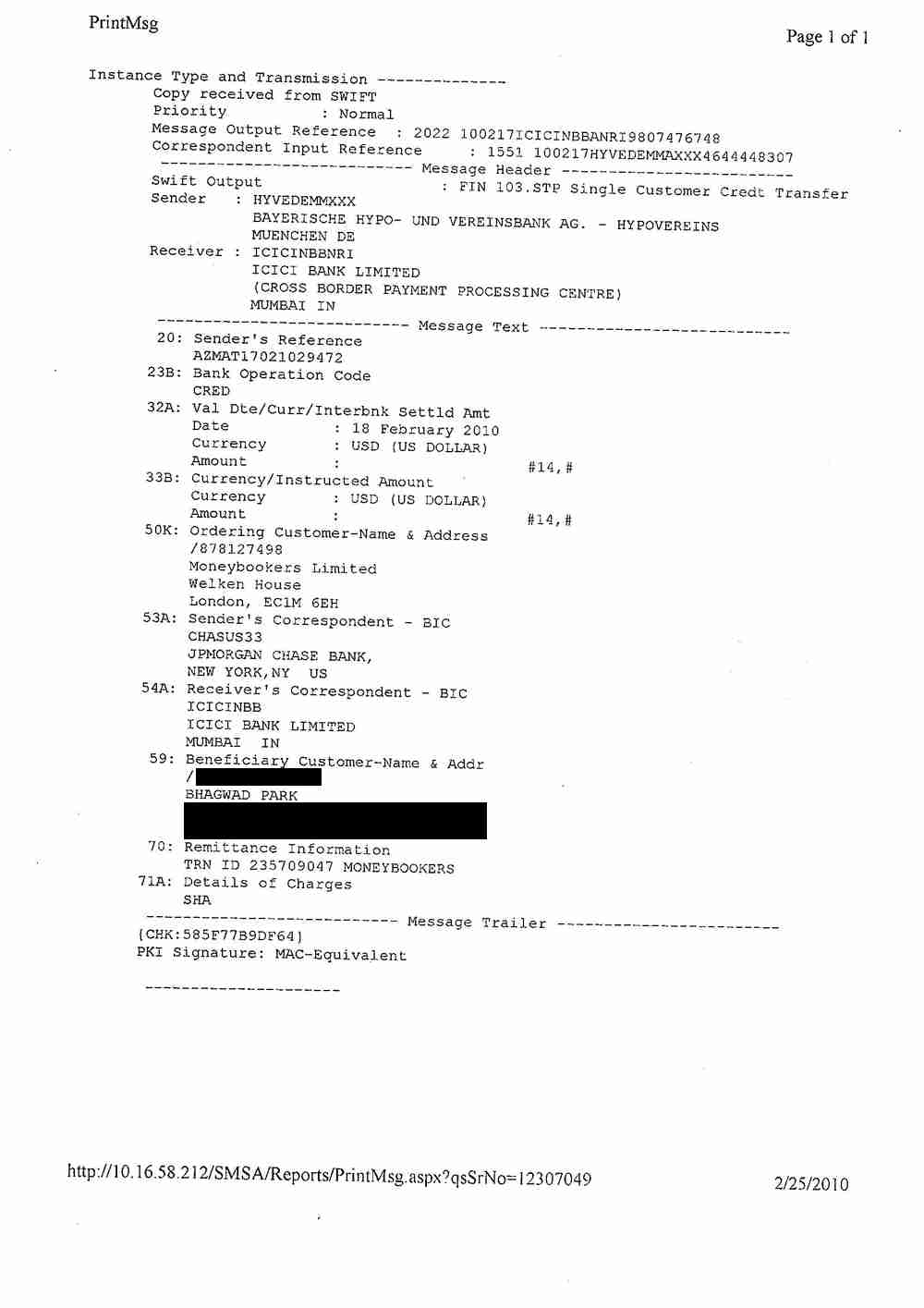

I was stymied and once again called up Moneybookers and pleaded with them saying that my bank couldn’t provide me with a statement showing them as the sender. They got back to me saying that if that was the case,I must at least get a full print out of the SWIFT transaction from my bank, scan it and send it to them. So off I went to ICICI the next day to do just that and obtained this document:

Praying to the (non existent) gods that they accept this as proof that I am indeed the owner of the Bank account in question, I sent it off to them and was rewarded two days later with an email from the security departing saying that my bank account has (at last!) been verified by their department. And my withdrawal limits were raised once more.

After my bank account verification, there was just one more thing for them to check up…

Commercial account vs Personal Account

I was reading some forums a week ago, when I came across the disturbing news that if I was using Moneybookers to receive payments for goods or services (which as a writer, I am), then I must have a commercial account and not a personal one. When you sign up for a Moneybookers account, you’re asked if you’re an individual or a company. Since I’m an individual, I got a personal account instead of a commercial one.

I went back and read the Moneybookers TOS and saw that if they suspect that I’m using a personal account to receive commercial payments, their security team will freeze the account and ban me. I was scared, and once again placed a call to them telling them that I’m a freelancer and that though I use my account for commercial purposes, I’m not a company but an individual. They got back to me with a mail saying that if that was the case, they would treat my account as a commercial one and that they wanted two further documents from me to prove my identity, namely:

- A scanned copy of a government issued document with an expiry date

- A utility bill that has actually arrived by post in the past 3 months

I was only too happy to send them a copy of the front and back of my passport, but I had a problem with the second requirement. Internet techie that I am, I pay every single bill of mine online and when I sent them my reliance Internet bill which arrived by email, the security team told me that it must be a scanned copy of a bill that was actually received by post in the last 3 months. Since I’ve just got back from outside India, I don”t have any such bill and had to wait for a while to obtain it.

They also sent over a “Merchant questionnaire” word document requesting details about my business and what I do etc etc. They told me to leave out the fields which are not applicable, and there were many like this since I’m not a company.

As matters stand, I’m still waiting for my Internet bill to arrive by post so that I can finish up this final verification stage. I finally got my Internet bill by post, scanned it (and scanned the envelope before opening it for good measure!), filled out the questionnaire with all details that were applicable to me and uploaded all three documents to the Moneybookers security team. I got back a reply in less than an hour thanking me for sending across the documents and informing me that all was well.

So that was the end of the verification procedures for me. I’m completely verified and all set to go! I’ve already withdrawn several thousand rupees into my ICICI bank account from Moneybookers and it’s been a better experience than Paypal due to the higher conversion rates.

I only wish there was some way to transfer money from my Paypal account to Moneybookers, since Paypal withdrawals into Indian bank accounts are more expensive and are fraught with complications thanks to the recent RBI ban. Moneybookers seems to be a professional company, and though their verification procedures can get a bit on one’s nerves, it’s that very scrutiny that inspires trust.

So here’s hoping that more Indian providers will ask their clients if they use Moneybookers for payments and if so, open an account with them.

is it necessary to have a working status to get b2 banking from icici bank.

My friend is in ghaziabad where he can get icici b2 digital banking service, but he is not employed yet he is a student. can he get b2 banking service from icici?

Kindly suggest the steps?

ICICIb2banking website require company infowhn filling application online?

How to avoid that?

Hello,

Thank you very much for this wonderful post. I was wondering whom to consult regarding moneybookers and how it works in India. But thanks to your post, almost all my doubts are cleared. I have a few questions and I will be glad if you can take out the time to answer:

How much time does it take to verify your bank account? I have an account with Axis bank.

Also, do u need address verification done to withdraw money(I know about the limits, I want to know if its binding to verify your address before you do any transactions)?

You are doing great work by guiding fellow Indians. Keep it up :)

Thank you

Ankita

Well my experience with MoneyBookers has been very disappointing. Though I recd the payments at a very good rate in my MB account, but when it was transferred to my Indian Bank Account, there was a loss of as high as 20%. Case History…

1. Default currency in my MB account is INR

2. Funds were recd in USD and a good exchange rate was given

3. Out of the recd funds, I withdrew INR 5000 in my SBI Savings Account

4. As per their policy, they converted the funds to EURO and deposited in my bank. Ideally it should have been 69 EURO (approx exchange rates in dec 2012), but what I got in my SBI is only 51.77 EURO. In short what I got in the end is Rs 3719 (that too when SBI gave a good conversion rate and charges only Rs 31 as fee)

I don’t think that even if the account was set in EURO or USD, it would have made any major difference.

Repeated emails to them gave no response. :(

So me back to Paypal now

Regards

Nimit

Hi, I have just registered AC with money bookers where currency is set for USD as i am in india but get payment in USD. Also done email verification and address verification is due as they have send letter which takes 5 days.

I have added my bank AC no with SWIFT code to receive payment. Now is it compulsory to add debit card to active my account ? Please clear my doubts.

HI! Your article was of great help as I was desperatly trying to withdraw my money from moneybookers and have been facing the same problem with the SWIFT Code that the customer rep gave me. So I tried the number that you used ICICINBBNRI. It got recognized as ICICI bank , mumbai. My account is in Noida. Still I added my account number and it was successfuly added. Did you have your account in some other city than Mumbai too. I am afraid to withdraw money, thinking that It might go to some other branch in mumbai. Can you help. You seem to be more knowledgebale than cust rep of icici banks.

In reply to Sahil Bhatia

Yes, my account is in Chennai. As far as I know, you can safely withdraw your money.

hello bhagwad,

my name in skrill account is atul sharma,but my name in my bank account is atul kumar sharma,my question is that will there be any problem during withdrawal to my sbi bank account as my middle name(kumar) is not in the skrill account .

thanks:-)

Thanks for your detailed post on Moneybooker. I would like to open an account with them but which bank they support. Is HDFC Bank or Bank of India has tie-up with Moneybooker and can link their debit card with them (Paypal has no tie-up so unable to link debit card).

Hello,

I would like to share my experience with moneybookers. I have never used paypal because of the reforms in RBI rules. I use my Axis bank account for withdrawing money and I get it in my bank the next day. I have noticed that no matter what amount i withdraw, my bank cuts only Rs 550/- including the conversion fees and some other charges.

Overall, I have not faced any issues with MB and I love their services! It is so hassle free and convenient.

Ankita

Will I be able to withdraw funds from Moneybookers to my ICICI bank b2 account?

best article written for indians who want to use Moneybookers, i am thinking to

verify my account soon, however i have some questions.

suppose i verify only my postal verification, will be able to qualify for withdrawal?

i mean do you need to verify your bank account before withdrawing ?